The profit margins of many Spanish ICT wholesale and retail businesses remain tight, which is mainly due to high competition in terms of sales prices.

- While ICT sales have increased steadily over the last couple of years, turnover growth has slowed down in 2017 and 2018 to 1.2% and 1.7% respectively, after a 5.4% increase in 2016. The slower growth rates are due to lower demand from both private and public buyers. Sales are expected to grow about 2% annually over the next five years.

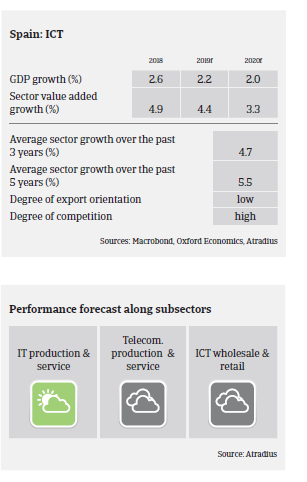

- A significant number of ICT businesses belong to multinational groups, and the amount of foreign investment is stable. However, the Spanish ICT trade balance is structurally negative, as the export level is low.

- Margins of many ICT businessess remain stable but tight, especially in the ICT wholesale and retail subsector. This is mainly due to high competition in terms of sales prices.

- In general, financing requirements are average in the ICT sector, and banks are willing to lend to the industry. However, it is important to differentiate along subsectors, as the liquidity requirements of IT producers are significantly lower than those of wholesalers and retailers, which have higher working capital needs and are highly dependent on short-term lines of bank credit.

- On average, payments in the ICT industry take between 30 and 60 days, and the payment behaviour over the past two years has been good. The level of both payment delays and insolvencies in the ICT sector is low, and expected to remain stable in 2019.

- Our underwriting stance for the industry remains generally open to neutral, with closer monitoring of highly geared small- and medium-sized businesses. When underwrting ICT wholesalers and retailers it is important to take into account available lines of credit and outstanding balances in order to assess the liquidity situation.

Downloads

1.13MB PDF