Larger suppliers could seize the opportunity of buying distressed smaller players in order to expand market share and bargaining power against OEMs.

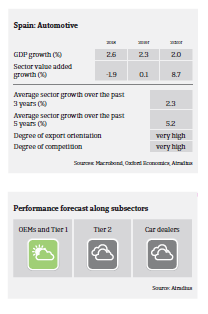

- Until 2017 the Spanish automotive sector benefitted from robust global demand. However since 2017, domestic vehicle production has started to decrease (albeit slightly) and the market outlook for 2019 remains subdued.

- Despite decreasing profit margins and more challenges ahead (increased global economic and political uncertainty, tighter environmental regulations, changes in concepts of mobility) many Spanish suppliers are financially resilient and therefore seem to be able to adapt to market changes.

- While external financing requirements and gearing are generally high in this sector, banks are willing to provide credit to the industry, for both short-term financing (working capital management) and long-term facilities (i.e. capital expenditure financing).

- On average, payments in the Spanish automotive sector take around 60 days. Payment experience is still good, and the level of protracted payments has not been overly high over the past couple of years. Non-payment notifications are low and we do not expect major increases in the coming months. The level of insolvencies in this sector is low and no major increase is expected in the coming 12 months.

- Currently we do not expect the market adjustment to lead to a serious deterioration of the credit risk situation in the Spanish suppliers segment in the coming 2-3 years. Many businesses are competitive and have international branches, benefiting from growing demand in some overseas markets in the coming years. We expect that the price pressure of OEMs on Spanish suppliers will remain limited so as not to provoke major supply chain interruptions, with the most likely scenario being joint adjustment efforts.

- That said, several Tier 2 players with already tight profit margins and high indebtedness may not succeed in adapting to the challenges ahead. Some insolvencies could occur, but in many cases larger players are expected to seize the opportunity of buying distressed smaller players in order to expand their market share and bargaining power against OEMs.

- Automotive is an important industry for Spain, accounting for 10% of GDP, employing 9% of the total workforce and providing investment in remote regions of the country thanks to the presence of assembling/production plants. Therefore, government support can be expected should too many businesses face trouble. Currently the Spanish government is trying to reach agreements with the main European manufacturers and with China to set up car battery factories in the country.

- Our underwriting stance remains generally open due to the low claims ratio, good payment behaviour and the industry’s strengths. However, in the Tier 2 producer segment we are more cautious with smaller businesses that are showing financial weakness (e.g. high leverage, low profit margins). Car dealers are currently facing lower sales and strong competion.

Downloads

1.19MB PDF